Finnfund leverages financing for sustainable development globally by providing investment opportunities for private investors. Mobilising private capital is key to achieving the Sustainable Development Goals (SDGs) in developing countries, given that the UN estimates the financing gap at USD 2.5 trillion per year.

Increasing the level of private capital is therefore one of Finnfund’s strategic goals and we work as a catalytic investor by leveraging partners, additional capital and expertise for projects that contribute to progress towards the SDGs. Moreover, we use our leverage as a development financier to encourage our investees to constantly improve their sustainability practices towards people, the environment and society.

By setting up a Sustainability Bond Framework, Finnfund aims to mobilise debt capital to support our mission to generate lasting impact by investing in businesses that solve global development challenges.

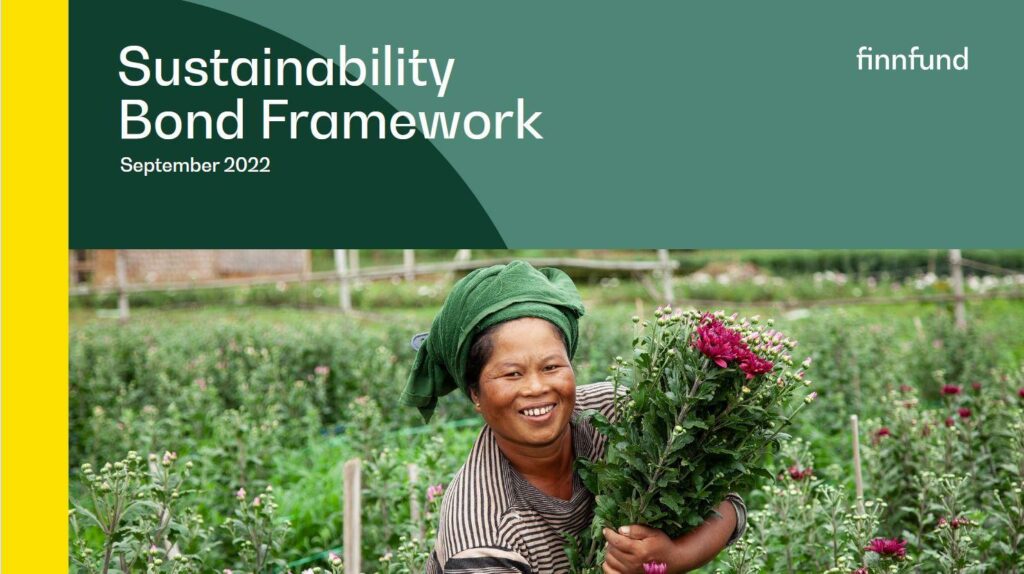

Sustainability Bond Framework

The Sustainability Bond Framework is aligned with the Green Bond Principles, Social Bond Principles, and Sustainability Bond Guidelines, all as published by the International Capital Market Association (ICMA) in 2021.

The framework, outlined in the figure below, allows Finnfund to issue three types of bonds:

- Green Bonds, to finance and/or refinance eligible green lending, equity investments, and mezzanine financing mainly targeting the objective of climate change mitigation and adaptation (“Green Projects”);

- Social Bonds, to finance and/or refinance eligible social lending, equity investments and mezzanine financing mainly targeting improved living and health conditions for underserved groups (“Social Projects”);

- Sustainability Bonds to finance and/or refinance a mix of Green Projects and Social Projects.

Second-party opinion

Sustainalytics has provided a second-party opinion to this Framework, verifying its credibility, impact, and alignment with the ICMA Green Bond Principles 2021 and Social Bond Principles 2021, as well as with the Sustainability Bond Guidelines 2021.

You may find the framework and and the second -party opinion below.

Bond platform covering potential

bond formats, green and social

project categories, and examples of

impact indicators to be measured in

the annual impact reporting.

Reporting

Finnfund will annually, until full allocation and in the event of any material developments, provide investors with a publicly available Sustainability Bond Report describing the allocation of proceeds and the social and environmental impact of the Eligible Projects.